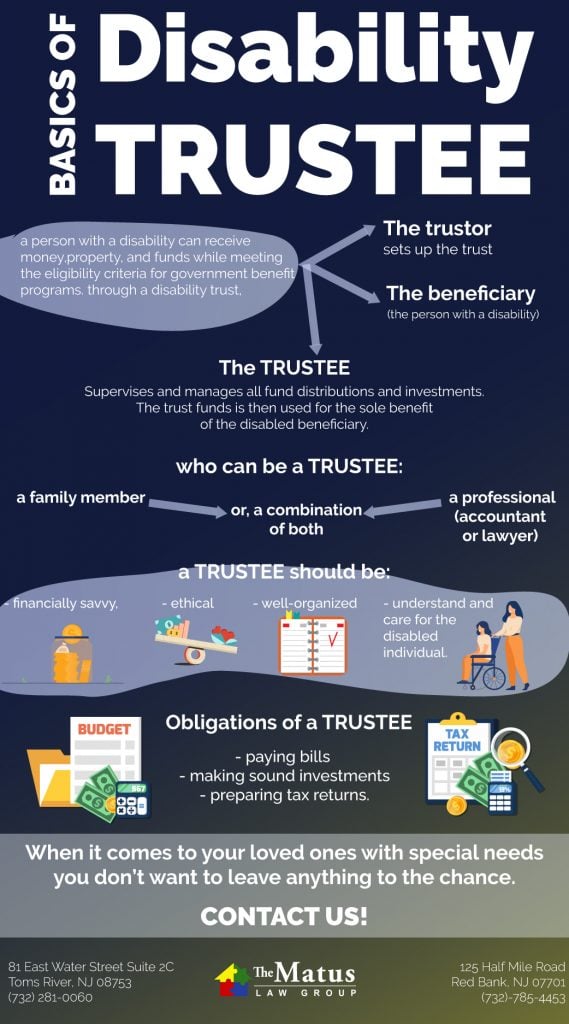

Under a special needs trust in New Jersey (SNT), a person with a disability can receive money, property, and funds while meeting the eligibility criteria for government benefit programs. In a disability trust, three parties are directly involved: the trustor, trustee, and beneficiary. The trustor sets up the trust for the beneficiary (the person with a disability) and the trustee manages it. A special needs trust attorney in NJ can help you create and customize the disability trust to benefit the disabled individual.

If you are navigating complex matters regarding disability trusts in New Jersey, consulting with a New Jersey special needs trust attorney can offer valuable support, even regarding discretionary support trusts. At The Matus Law Group, our attorneys are well-versed in the nuances of special needs trusts and can provide comprehensive legal guidance. We can help trustors set up a disability trust that accommodates the beneficiary’s needs while maintaining eligibility for public assistance programs. Our team can also assist trustees in managing and fulfilling their responsibilities to safeguard the future of their loved ones as intended. Contact us today at (732) 785-4453 to schedule a consultation.

What is a Disability Trustee in New Jersey?

In New Jersey, the trustor of the disability trust fund cannot control or cancel the trust. Instead, they must assign a trustee to supervise and manage all fund distributions and investments. A special needs trust attorney will create the trust, customize it, and ensure that the trustee has the powers needed to administer the trust fund. The trust funds are then used for the sole benefit of the disabled beneficiary. In many cases trustees are family members, however, in some cases, the trustees are paid a flat fee, hourly fee, or a percentage of the trust’s assets for their services. In these cases, the trustee is often a professional, such as a lawyer or an accountant.

How to Pick A Disability Trustee?

Choosing the right trustee for a disability trust is critical. The trustee must be willing and have the necessary expertise to manage the trust. That includes paying bills, making sound investments, and preparing tax returns.

A disability trustee can be a relative, an outsider, or both. The idea of a professional trustee is beneficial, but it often makes people uncomfortable. In which case, the best combination is to appoint both a professional and a family member. In this case, the professional serves as a trustee alongside a family member like a parent or sibling.

To sum it up, a trustee must be financially savvy, ethical, well-organized, and most of all understand and care for the disabled individual.

What are the Duties of a Trustee of a Special Needs Trust?

Unlike regular trusts, the responsibilities of a disability trustee may be more complex. The trustee of a disability trust holds a crucial and demanding role, charged with multiple responsibilities to ensure the trust operates effectively and in the best interest of the beneficiary. A critical part of a trustee’s job is to ensure the trust funds are utilized solely for the benefit of the beneficiary. Their main responsibilities include managing the assets as per the instructions in the trust document and tax filing. Accountings are due (at least) annually, at the time of eligibility determination, or redetermination to the eligibility.

The trustee of a disability fund can pay for almost anything as long as:

- The purchase is not illegal

- Does not go against the public policy

- Do not violate the terms of the trust

If the expenses go above $5,000 or deplete the trust’s principal, the trustee is required to send an advance notice to the Department of Human Services in New Jersey (DMAHS). If the DMAHS finds the expenditure inconsistent with the trust expenses, and/or not beneficial for the trust beneficiary, it will notify the trustee and the eligibility determination agency in writing. An estate planning lawyer can help the trustee manage the process.

Besides managing the trust’s assets wisely and prudently, other key duties of a trustee can include executing the terms of the trust agreement faithfully, avoiding delegating their responsibilities to others, keeping clear and accurate records of all transactions and activities related to the trust, and communicating with beneficiaries regularly about the trust’s administration and any relevant developments.

For trustees of special needs trusts, an additional layer of complexity is present due to the need to preserve the beneficiary’s eligibility for public benefits such as Medicaid or Supplemental Security Income. These benefits have strict eligibility criteria, often related to the beneficiary’s income and assets. A trustee must, therefore, have a thorough understanding of these rules to prevent any financial decisions that might jeopardize the beneficiary’s access to these crucial benefits. Failure to adhere to these guidelines can lead to the beneficiary losing their benefits, which would constitute a breach of the trustee’s duties.

Managing a disability trust requires diligence, a robust understanding of the law, and a commitment to the beneficiary’s well-being. If you are considering taking on this role or are currently managing a disability trust and need guidance, consulting with a knowledgeable New Jersey special needs trust attorney can help ensure that you fulfill your duties effectively and protect the interests of the beneficiary.

| Duty | Description |

|---|---|

| Managing Trust Assets | Manage trust assets according to the trust document, ensuring they are used solely for the beneficiary’s benefit. |

| Tax Filing and Accountings | Complete annual accountings and tax filings, due at least annually or upon eligibility determination, adhering to trust guidelines. |

| Approving Expenditures | Ensure expenditures are legal, compliant with trust terms, and do not exceed $5,000 or deplete the trust’s principal without advance notice to DMAHS. |

| Notifying DMAHS | Provide DMAHS with advance notice of significant expenditures, allowing review to ensure consistency with trust expenses and beneficiary benefits. |

| Executing Trust Terms | Faithfully execute all terms of the trust agreement without delegating responsibilities to others, ensuring compliance and fulfillment of obligations. |

| Record Keeping | Maintain accurate records of all trust-related transactions and activities, ensuring transparency and accountability in trust management. |

| Beneficiary Communication | Regularly communicate with beneficiaries regarding trust administration and any relevant updates or developments, fostering transparency and trust. |

Get in Touch with a Top-Notch New Jersey Special Needs Trust Attorney

When it comes to your loved ones with special needs, you don’t want to leave anything to chance. However, it’s not always easy for people without legal experience to face the ups and downs of setting up or managing a special needs trust. An attorney can be helpful in both the setup and administration of an SNT. Working with a top-notch special needs trust lawyer, such as Christine Matus from The Matus Law Group, can help you ensure that the trust is created and handled well. With our support, you can further provide for your loved one, even after your passing.