Estate planning is a crucial process that offers a lot of value for New Jersey families. While it’s never fun to have to discuss what should happen in the worst of circumstances, having documents prepared such as wills, trusts, and power of attorney provides peace of mind in the event of accidents, illness, or death. As a law firm that deals with many estate planning questions, The Matus Law Group is often asked if these documents will ever need to be updated, and how often. While many people think that you should update your estate plan every few years – like every three to five years – the answer really depends on certain events in the lives of you and your family.

Before you make any decisions about your estate plan in New Jersey, it is important to speak with an experienced New Jersey estate planning attorney to ensure your estate plan is up to date. Regularly revisiting your estate plan is essential to ensure it reflects any changes in your circumstances, assets, or legal requirements. Contact us at (732) 785-4453 to schedule a consultation and discuss updates to your estate plan.

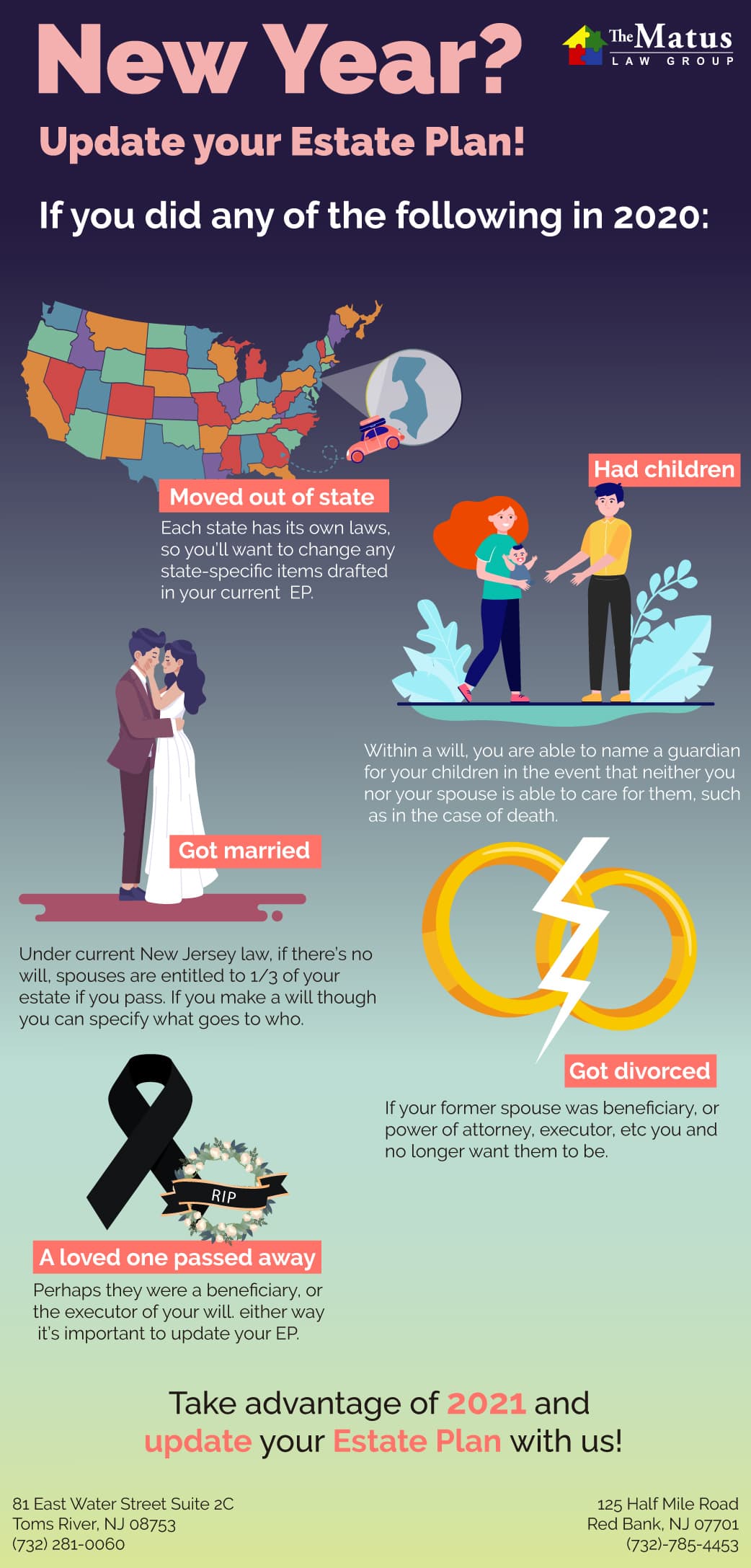

To help figure out if you need to update your estate plan, we’ve put together a list of the most common reasons to do so:

1. Moving Out of State

When you initially draft your estate planning documents, they are created under the laws of the state in which you live. Each state has different laws that apply when handling the affairs of an estate. If you ever decide to move to a new state, you’ll want to change any state-specific items by having these documents reviewed by an attorney licensed to practice in your new state. This is very important to keep updated with the expected estate taxes your heirs will be responsible for.

The same should apply if the executor you name in a will also moves out of your state. If you believe that this individual is no longer the best suited to fill the role due to their location, you should consider having your will updated.

2. Marriage

Many people believe that once they get married, their spouse automatically becomes the heir of the estate should they pass away. This is not true and their claim to the estate will differ depending on which state you live in. In the case of New Jersey, spouses are entitled to one-third of your estate, with the remaining distributed to the other relatives in your family. But by using a will, you can specify the exact amount you’d like your spouse to receive, overriding the proportions set out by the state. So when you get married, whether it be your first marriage or one you have later in life, consider meeting with your estate planning attorney to establish what you’d like to leave for your spouse.

3. Having children

You should update your will very soon after having children. Within a will, you are able to name a guardian for your children in the event that neither you nor your spouse is able to care for them, such as in the case of death. Without having a guardian explicitly named in your will, the courts will assign one in the event of your death. Since the courts decide without much consideration to the aptitude of the individual or input from the children, it’s always best for you to pre-select one you are confident will be able to provide the best case for your family.

If you have children with multiple spouses, this can add an additional layer of challenges to your estate planning. At times, it can be a challenge to ensure all of your children (and grandchildren) are cared for if you ever pass away. Therefore, it is best to speak with a highly-rated estate planning attorney before you update your estate planning documents to add beneficiaries or set up new trusts to set aside portions of your assets for all of your loved ones.

4. Death or divorce

Your spouse is likely to be included in some way on your estate planning documents. This can include being designated as a beneficiary, being an agent in a power of attorney, being designated as the executor of your will, and so forth. If you get a divorce or your spouse passes away, you need to review these documents with your estate planning attorney.

| Reasons to Update Estate Plan | Description |

|---|---|

| Moving out of state | Update state-specific items and consider changing executor if they move out of your state. |

| Marriage | Specify desired distribution to override default proportions for spouses. Consult with an estate planning attorney. |

| Having children | Name a guardian for your children to ensure their care. Consider complexity with multiple spouses. |

| Death or divorce | Review and update documents after divorce or the passing of a spouse. Consult an estate planning attorney. |

How Often Should You Update Your Will?

It is important to update your will whenever you consider it appropriate. As a general rule, it is recommended to update your estate plans every three to five years. However, if you experience any significant life events that warrant updates, there is no need to wait that long. Certain specific occasions call for a thorough review and update of not just your will but all your estate planning documents. These major life events may include:

- Marital changes: Changes in marital status, such as getting married or divorced, are common reasons for amending a will. If you have recently experienced a change in your marital status, it is crucial to revisit and update your will accordingly.

- New additions to the family: The arrival of new children or grandchildren, whether through birth or adoption, necessitates an update to your will. It is important to ensure that your will reflects your intentions regarding the distribution of assets to the new family members. It is important to be aware that stepchildren do not usually inherit automatically. Therefore, if you have a blended family and desire to include your stepchildren in your will, you will need to make deliberate modifications to your current will.

- Familial changes: In the event that a named beneficiary in your will passes away, it is necessary to update your will by either designating a new beneficiary or redistributing inheritances among the remaining beneficiaries. Similarly, if the person you have designated as the Executor of your will dies, you will need to select a new Executor. Other significant changes that may require updates to your will include selling or purchasing real estate, as well as acquiring or selling valuable assets like jewelry or art.

- Prior to a trip: Planning an extended trip for business or pleasure can be a good prompt to review your will and ensure that it reflects your current wishes. This is especially important if you anticipate being away for an extended period or if your travel plans involve potentially risky activities.

Remember, these are just a few examples, and there may be other personal circumstances that warrant reviewing and updating your will. It is essential to consult a New Jersey estate planning lawyer to assess and adjust your estate planning documents to align with your current situation and intentions. Schedule a consultation with The Matus Law Group to ensure that your will reflects your wishes accurately and comprehensively.

How Often Should a Trust Be Updated?

Regular updates to a trust are crucial to maintaining its effectiveness and alignment with one’s current wishes and legal circumstances. For residents of New Jersey, reviewing a trust should be considered a routine part of estate management.

A trust should be revisited and potentially revised following any significant life event. Such events include marriage, divorce, the birth or adoption of a child, or the death of a family member. These milestones may alter your intentions for asset distribution or necessitate the addition of new beneficiaries.

Additionally, changes in your asset portfolio warrant updates to your trust. Acquiring new assets like real estate, stocks, or other investments, or disposing of assets currently under the trust, requires adjustments to accurately reflect these changes in your estate plan.

Legislative changes can also impact the effectiveness of your trust. New Jersey law, like federal law, can evolve, and tax regulations can shift, affecting how trusts are administered and taxed. It is advisable to review your trust in response to any relevant legal changes to comply with current laws and optimize tax outcomes.

Finally, consider reviewing your trust every three to five years as a standard practice. This periodic review helps identify any other changes or preferences that might not be tied to specific events but are important as your life and goals evolve over time.

Regular reviews with a qualified New Jersey estate planning attorney can help keep your trust accurate, legally compliant, and aligned with your wishes, providing peace of mind that your estate will be managed according to your intentions.

Work With Top New Jersey Estate Planning Attorneys at The Matus Law Group

Your estate plan should not be a static set of documents that you keep in a vault and never look at. As you experience life changes, these documents will need to be reviewed as well so that they accurately reflect your current circumstances. For any legal advice regarding your estate plan, contact (732) 785-4453 to schedule an appointment.